Deciding between a Precious Metal IRA and solid gold investments can be difficult. Each option offers its own set of advantages and challenges. A Gold IRA, for example, allows you to put money in various bullion options within a tax-advantaged investment vehicle. Physical gold, on the other hand, provides tangible ownership of the asset.

To make the optimal choice for your financial goals, consider your risk tolerance, time horizon, and financial status.

The Ultimate Guide to Choosing Between a Gold IRA and a 401(k)

Planning for retirement can be daunting, but choosing the right vehicle is crucial. Two popular options are the Gold IRA and the traditional 401(k). Both offer valuable perks for your long-term financial security, but they have distinct characteristics that may make one a better fit for your situation.

A Gold IRA, as the name suggests, allocates your funds into physical gold. This can be an interesting option for investors needing to diversify their portfolio and potentially mitigate against inflation. On the other hand, a 401(k) is a retirement savings plan offered by employers. It allows you to save pre-tax income, which can reduce your current tax liability and allow your savings to grow gradually.

Choosing between these two options depends on several factors, like your risk tolerance, investment goals, and the details of your employer's 401(k) plan.

It's essential to carefully consider your individual circumstances and consult a financial advisor to determine the best retirement savings strategy for you.

Investing in Gold IRAs

Deciding whether a traditional Gold IRA is the right investment for your portfolio can be daunting. While gold offers protection against economic uncertainty, there are benefits to weigh. On one hand, a Gold IRA can hedge your existing portfolio, potentially offering returns click here during market downturns. However, it's important to appreciate the costs associated with maintaining a Gold IRA, and remember that gold prices can be fluctuating. Carefully evaluate your financial objectives before committing to a Gold IRA.

- Explore the trusted dealers offering Gold IRAs.

- Comprehend the fees involved in establishing and managing a Gold IRA.

- Consult a investment professional to determine if a Gold IRA aligns with your overall objectives.

Gold IRAs of 2023

Deciding on the best Gold IRA for your needs can feel overwhelming. With so many providers available, it's important to do your research. Fortunately, we've gathered a list of the highest-rated Gold IRAs in 2023, based on factors like rates, customer support, and security.

- That company offers a variety of IRA options to suit your specific needs.

- Deposit in precious metals like gold, silver and diversify your portfolio.

- Leverage from potential tax advantages associated with Gold IRAs.

Our recommendations can help you filter the best Gold IRA for your personal circumstances.

Choosing The Perfect Gold IRA Provider

Embarking on the journey to invest in a Gold Individual Retirement Account (IRA) may seem a daunting task. With a plethora of providers vying for your business, it's crucial to thoroughly research your options before making a decision. This comprehensive guide will provide you with the knowledge necessary to identify a reputable and trustworthy Gold IRA provider that aligns your individual needs and retirement goals.

- Begin by determining your specific investment objectives. What are you hoping to achieve through a Gold IRA? Do you be using it for long-term savings?

- Next investigate different companies. Read online reviews, evaluate fees and offerings, and seek suggestions from trusted individuals.

- Ensure that the provider is regulated by the appropriate institutions. This ensures your investment and provides assurance of mind.

Additionally, request information on the provider's experience in the Gold IRA sector. A reputable provider will have a successful record of assisting clients.

Exploring Gold IRAs: A Lucrative Strategy

Are you seeking ways to protect your retirement portfolio? Consider the advantages of a Gold IRA. A Gold IRA allows you to invest in physical gold, a tangible asset that has historically been considered a reliable store of value during economic uncertainty. Unlike traditional IRAs, which primarily focus on stocks and bonds, a Gold IRA offers the benefit of a unique investment opportunity.

- Potential for appreciation

- Protection against inflation

- Deductible contributions

Consequently, investing in a Gold IRA may be a sound move for those seeking long-term financial security and portfolio diversification.

Kelly McGillis Then & Now!

Kelly McGillis Then & Now! Romeo Miller Then & Now!

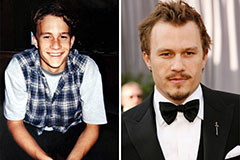

Romeo Miller Then & Now! Heath Ledger Then & Now!

Heath Ledger Then & Now! Atticus Shaffer Then & Now!

Atticus Shaffer Then & Now! Mike Smith Then & Now!

Mike Smith Then & Now!